Goal Based Advice

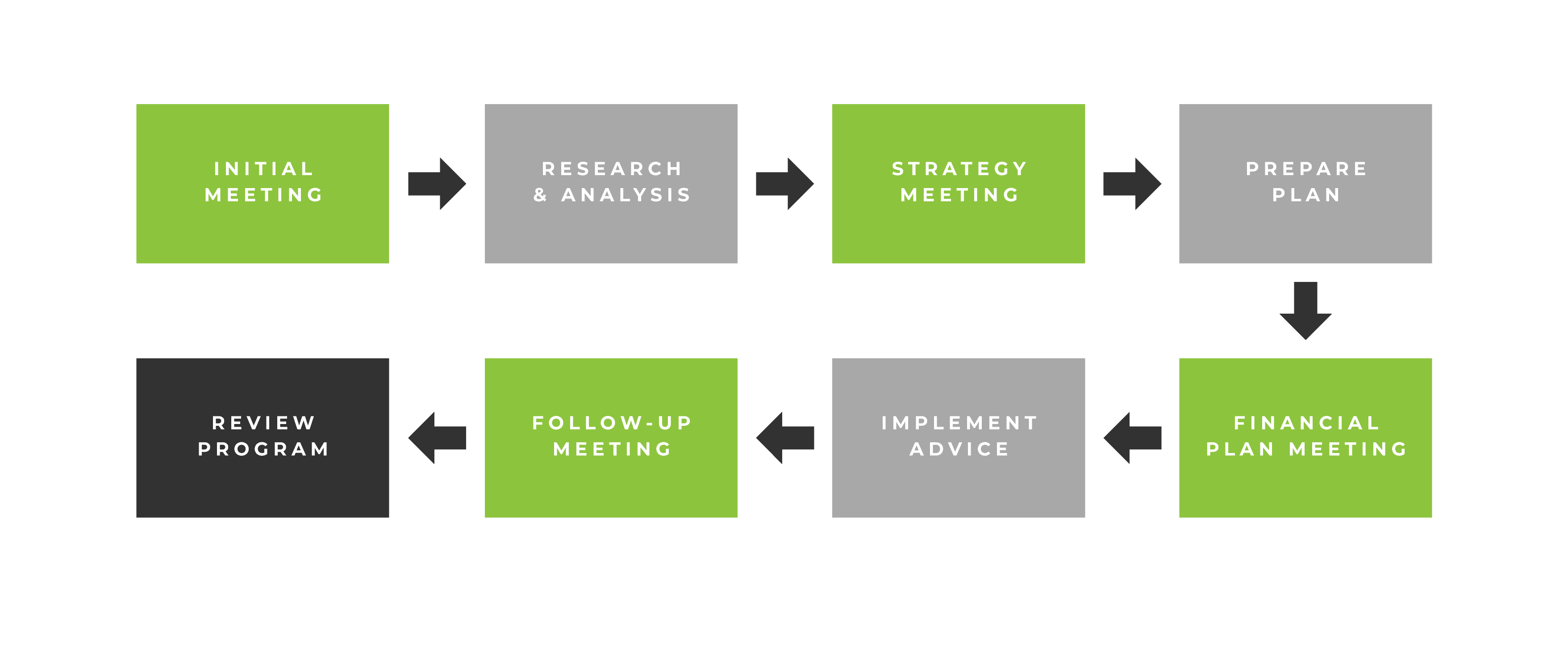

Ever since Profusion Planning was founded by Stephen and Brad in 2009, the core premise of our advice has been linked to the goals of our clients. This is reflected in our process that has been custom built to ensure we capture everything that is important to you

1. Initial Meeting

Discovery – Getting to know each other

This meeting is a chance to get to know each other and discuss ways we may be able to help you. It’s also an important opportunity for us to talk about your current situation and goals. As well as your budget we’ll discuss your approach to investing, what’s important to you and what you want to achieve in life.

2. Strategy Development

How we achieve your goals

Your adviser will work with a team of experts to devise strategies to help you meet your financial and lifestyle goals. This could include areas such as wealth creation, superannuation and retirement strategies, life insurance, aged care and estate planning.

3. Your Financial Plan

Making our Recommendations

Your comprehensive financial plan will outline how our strategy will help you achieve your goals. Importantly, your plan steps you through the reasoning for the recommendations, the key benefits and considerations and when you’ll need to make the changes. To make sure you can track your progress, it also contains targets to measure your success against

4. Implementation

Making it happen

This is where the rubber hits the road! Our expert team takes control of the changes and guides you through the steps required to action your financial plan. This might include purchasing new investments, establishing superannuation income streams, assisting with finance arrangements, or setting up new life insurance. Whatever the change, you can sit back and relax knowing you are on the road to financial freedom.

5. Review Program

Taking care of you

This is the most important part of our process because life changes! To make sure our service fits your specific circumstances, we have three programs you can choose from. Importantly, they are not an ongoing arrangement, meaning you’ll have confidence that the advice service you select each year is tailored to fit your circumstances as they change over time.

Personalised Approach

Our team is friendly, enthusiastic and is always striving to deliver exceptional outcomes. Our experienced advisers are committed to ensuring you are properly understood and are all about giving you added confidence by having a specific plan to follow – managing finances shouldn’t be stressful!

Investment Philosophy

Profusion Planning’s investment philosophy is to ensure the portfolios constructed for our clients are closely aligned to the objectives of the individual. While this sounds simple, it is quite different to how portfolios have traditionally been designed within the financial services industry. This is because, most superannuation and investment providers, offer investment options that are linked to a risk category (ie. Defensive through to High Growth). This method is based on a split between defensive and growth assets, however has no real connection to the goals an individual has, nor the time at which they might need funds. It is for this reason that Profusion Planning uses an Outcome-based Investment approach.

Goal Based Advice

Ever since Profusion Planning was founded by Stephen and Brad in 2009, the core premise of our advice has been linked to the goals of our clients. This is reflected in our process that has been custom built to ensure we capture everything that is important to you

Family & Estate Planning

Estate planning is the process of working out how best to look after your affairs both when you are alive and when you pass away. Having a detailed estate plan is important because it helps to ensure people you trust look after you in the event you lose capacity to make decisions for yourself and will also provide clarity about distribution of your assets, care of your dependents, control of your home and business as well as help minimise risks such as those who might challenge your estate.

Get In Touch

Make the first step and contact us today for a confidential chat about your financial situation

Address: 333 Pier Street, Perth WA 6000

Postal Address: PO Box 8445 Perth BC WA 6849

Phone: (08) 9316 3050